Government Hacks

Just Saying

“Reality and facts bedamned” sums up how one scribe put it today after the job numbers came out yesterday.

The massage crew at the BLM were at it again. It’s an election year and as the incumbent continues doing poorly in the polls to put it mildly and he needs all the massaging his government hacks can provide.

“Commenting on the report, Bloomberg economics chief Ana Galvao writes that “the combination of a mild upside surprise to payrolls but an unexpected increase in the unemployment rate muddles the picture for markets. BE’s Macro-Finance SHOK model suggests forecasts for Treasury yields would be little changed.”

“And here is Capital Economics, which - very naively - had the second lowest payrolls forecast for February as if the Biden admin would ever admit the ugly truth: “The downward revisions to previous months gains leave recent growth looking less strong than previously thought. Alongside the rise in the unemployment rate to a two-year high and a much weaker rise in wages, there is less reason now to be concerned that renewed labor-market strength will drive inflation higher again.”

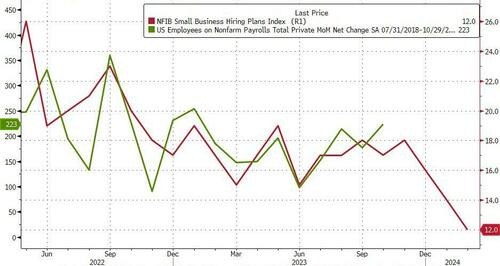

One thing is certain: markets loved the print with futures spiking to a new all time high and the dollar sliding to a new one-month low, as the BLS mandate of doing everything in its power to push markets ever higher until the election - reality and facts be damned - comes into full view. As for the reality, the following chart showing the correlation between private payrolls and the NFIB survey's Small Business hiring plans (because in America it's the small business that are responsible for most of the hiring), should tell you all you need to know. Source

Reuters chimed in with this.

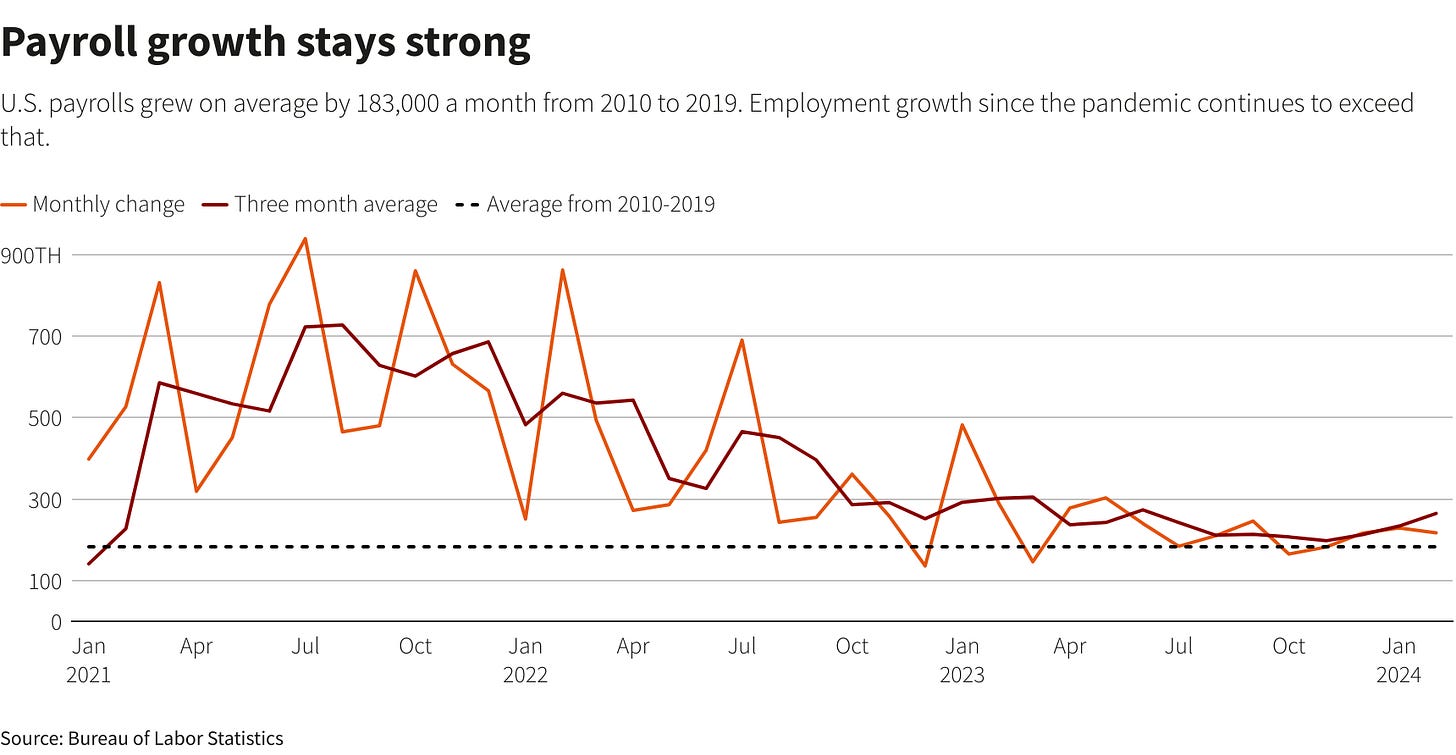

“Federal Reserve policymakers weighing when to start interest-rate cuts got another reason Friday to sit tight for now, after a government report showed jobs growth surged in February but the overall labor market continued to show signs of cooling.

“Employers added a robust 275,000 jobs last month, a Labor Department report showed on Friday, handily beating the 200,000 that economists expected.

“Still, the report's revisions of prior months' estimates showed smaller job gains in January and December than had earlier been thought, suggesting that a long-anticipated slowing in job gains is underway. The U.S. unemployment rate rose to 3.9%, its highest in two years, though still below levels the Fed sees as sustainable in the long-run.”

Recall the rabbit in Alice and Wonderland who was late, late, hello goodbye for a very important date. Well, that’s investors waiting anxiously for the Fed to cut rates.