Could it be as Bloomberg apparently Sunday evening warns, fresher than a new loaf of baked bread?

“A fresh wave of bullishness is washing through the oil-options market as the confrontation between Israel and Iran escalates, with activity led by unusually heavy trading of call options at the week’s open.

“Following a weekend when the two sides traded fresh blows, including hits to energy infrastructure, several thousand lots of August calls with strike prices of more than $80 a barrel — which profit when prices rise — changed hands in the first few hours of Monday’s session. At the same time, about 2,000 lots each of August Brent calls, with strikes of $100 and $101, also traded.

“Options don’t typically trade to this extent during the Asian portion of the day. It’s also not immediately clear whether the options activity was part of a wider strategy.”

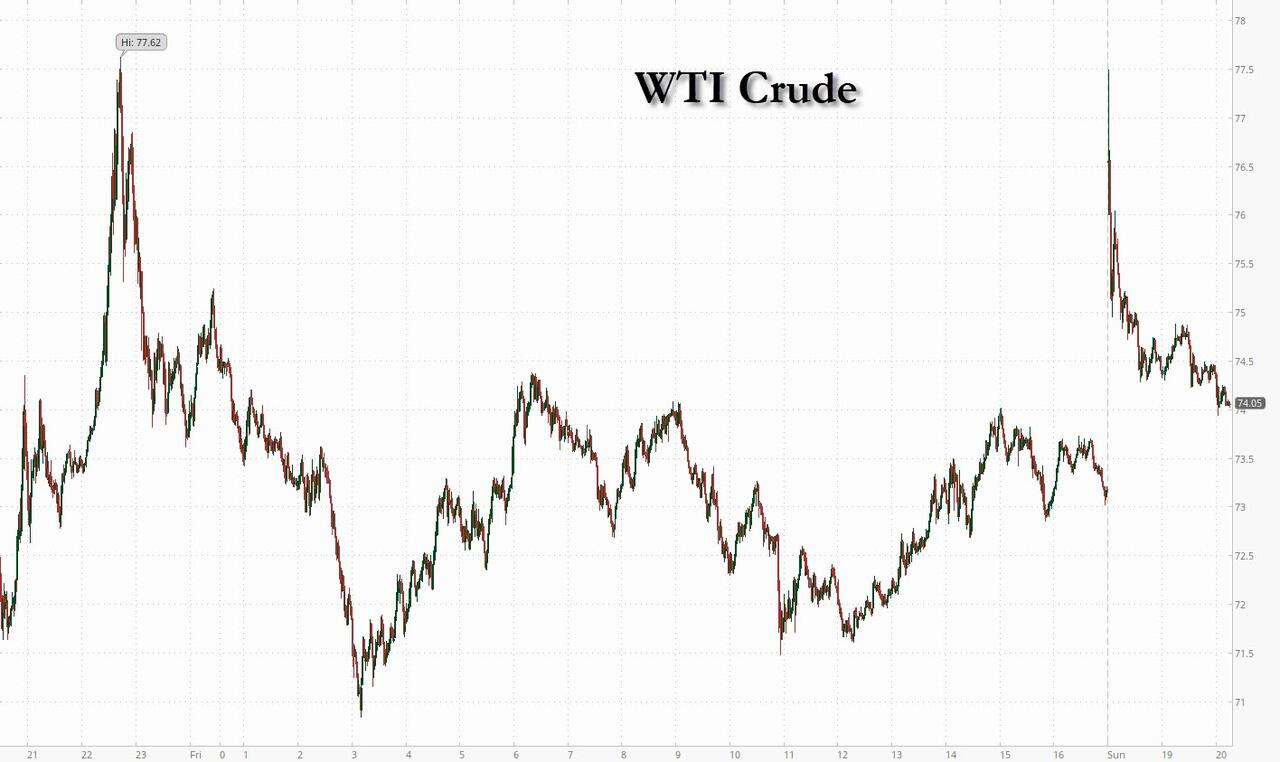

“Oil jumped in late Sunday trading with investors focused on escalating geopolitical tensions as Israel and Iran continue to bombard each other with no sign of a pause, amid some speculation the worst-case scenario - a blockade of the straits of Hormuz which could send oil as high as $130 - is increasingly likely (odds rising to 17% according to JPM).

Brent crude rose as much as 5.5% to $77.50 - its Thursday night high - in early Asian trading after Israel and Iran continued attacks on one another’s territories over the weekend. The price then promptly ease back as shorts who stand to suffer massive losses in case of a squeeze, doubled down by shorting even more in hopes the crises somehow de-escalates.

“That's a problem because unlike late last week, over the weekend Israel started attacking Iran's energy infrastructure, and on Saturday launched an attack on the giant South Pars gas field in the Persian Gulf, forcing the shut down of a production platform, after air strikes on Iran’s nuclear sites and military leadership last week.” Source