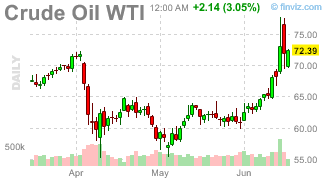

Oil prices move higher as the Fed’s Jerome Powell speaks Wednesday. Up to now they have been in their “long pause” phase and higher oil prices might scare them further on any interest rate changes.

Could it be another developing round of “transitory” from the Fed’s incompetent past? Nervous investors might not have to wait long to see.

Meanwhile, put price insurance on the market in general is rising.

“Sentiment shifted on Tuesday as investors reacted to fast-moving developments in the Middle East and their potential impact on global markets. While traders had earlier shown confidence the conflict would be contained, oil remains in focus, with a commodity that had hovered near pandemic-era lows emerging as an unexpected source of inflation. As Israel and Iran continued to trade attacks, Trump left the Group of Seven leaders’ meeting in Canada early to deal with the crisis. Though he hasn’t outlined what comes next, Trump told reporters aboard Air Force One he was looking for “a real end, not a ceasefire” to the conflict.

"Today’s downward movement, triggered by Trump, could actually last for a few days or even a few weeks,” said Alexandre Baradez, chief market analyst at IG in Paris. “There’s been little progress on trade negotiations and now there’s an added geopolitical risk. I don’t see a selloff but the VIX could certainly move higher.”

“The risk of oil-driven price pressures adds to the uncertainty facing central banks. Fed officials have signaled a prolonged pause in interest rates, and investors will be watching Chair Jerome Powell’s remarks on Wednesday for clues about what could eventually prompt a policy move, and when.

“Oil prices could spike to $120 a barrel if attacks by Iran halts traffic in the Strait of Hormuz, according to Jim Reid, global head of macro research and thematic strategy at Deutsche Bank, who agreed with an identical assessment from JPMorgan last week. “The Fed has got so many conflicting forces at the moment,” Reid told Bloomberg TV. “Tomorrow the Fed is just going to stay put and not give too much away. The oil price would give them another reason just to sit and wait.” Source