When morning becomes morning. Hope yours is going well. As they use to repeat in boot camp: “Listen up!”

Trump wants a rate cut. He and Fed Chair Powell are at odds to say the least.

Powell has until early 2026 left on his term as chief interest rate cook and bottle washer. Theoretically, he can’t be fired.

The central bank as usual is that big mess on the kitchen looking for a place so you have to clean it up.

A softer than expected CPI today has bolstered future rate cuts as many believe recession not inflation is the problem ahead.

Meanwhile, there’s always the noise as oil continues its rise on news that Trump and Iran can’t find the same nuclear page to agree on.

And a rapidly approaching summer will most likely bring with it more hateful democrat sponsored, instigated and paid for insurrectionists protests.

Life’s not always fun and giggles. Decision time approaches. Another old military ditty, “Get on the ball or get on the bus!” or it’s cruder version, “Shit or get off the pot!” time rapidly wrestles its way into the equation.

Are you ready?

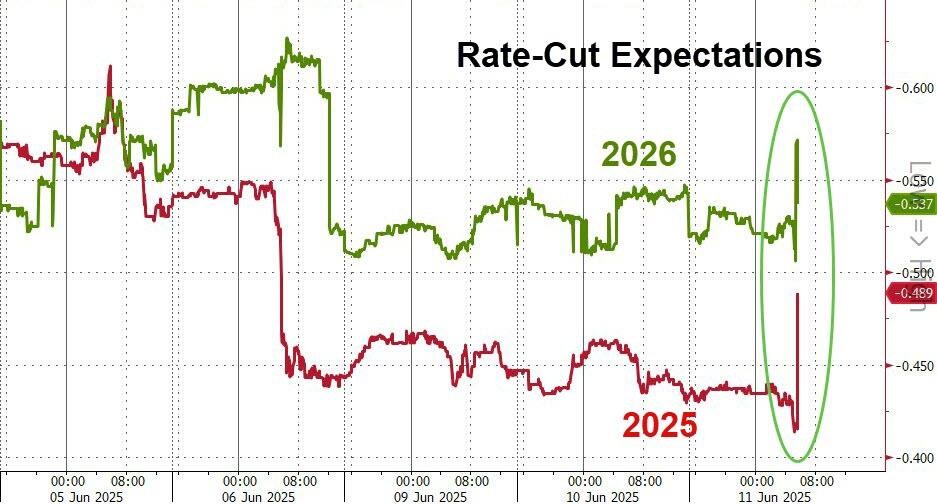

A 'disappointing' CPI print (cooler than expected) has promoted a surge higher in the market's expectation for rate-cut...

Source: Bloomberg

Prompting a surge higher in EVERYTHING.

Stocks spiked...

Treasuries were aggressively bid with 10Y yields sdown 5bps...

Source: Bloomberg

The dollar fell...

Source: Bloomberg

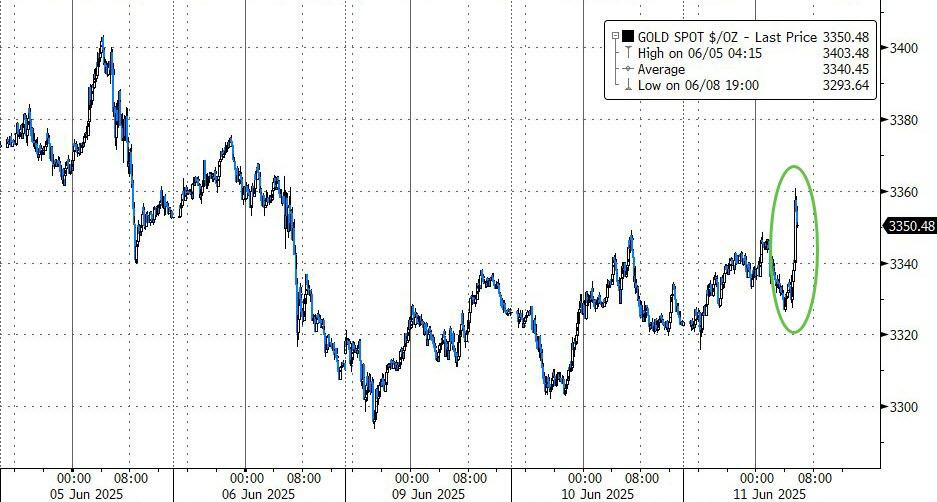

Helping gold to accelerate...

Source: Bloomberg

Goldman said that this would be a materially dovish print (<0.25% MoM for Core CPI) would prompt the bond market to add back at least 2x 25bp rate cuts (it already has) and for Equities to react positively (up 2-2.5%) to the bull steepening that likely ensues.

What excuse will Powell come up with next to NOT cut? Source